Good Morning Everyone,

The concept of trend is a critically important one. A trend is like an object in motion. When thinking in probabilities, a trend is much more likely to continue than it is to reverse. That’s not to say it can’t reverse, simply that it’s less likely. Whether you are starting a business, changing careers, playing poker or are a trader within financial markets, understanding the probabilities or the odds, is of supreme value, and in most cases you would prefer to get on the side of the probabilities. That is to say if something had a 60% hit rate, meaning 6/10 times you will “win“ with a given strategy, you would much prefer that than something with a 30% hit rate. The human brain typically struggles with this, but we’re often best served by viewing success over a series of attempts rather than just a single one. Just like at the gym, you don’t go to the gym once, fail to get a six pack and then give up. The process of conditioning the body is one that is an accumulation of sustained effort over time.

A common turn of phrase amongst many traders is “The Trend Is Your Friend“. Understanding trends is one of the most important things to grasp as a trader. Trends can exist in multiple time frames, from a 1minute or 5min chart, to a monthly or quarterly chart. There are much larger patterns and trends at play that extend far beyond these, and extend over hundreds of years like the long term debt cycle and the Fourth Turning.

Patterns are an artefact of nature, and thus they are an artefact of human behaviour. We are nature. Just as any other animal or organism that exists is too. The longer a pattern or trend has existed for, that is the higher the timeframe the trend can be confirmed on, the higher the signal typically is, and the higher the probability the trend would continue.

“An object in motion tends to stay in motion.”

A major reason why it’s so valuable to properly understand trend is because of the psychological disposition we have to be anticipating its eventual end, and fading it early. There is no shortage of people who have bet against a trend by shorting it and been absolutely rekt. As i said, it’s not that it can’t reverse, but the probabilities are not on your side. Which means over time you lose given enough attempts. Being able to identify this enables a trader to verify once that dynamic has switched around, and then reconfigure their psychological biases to be in alignment with the change.

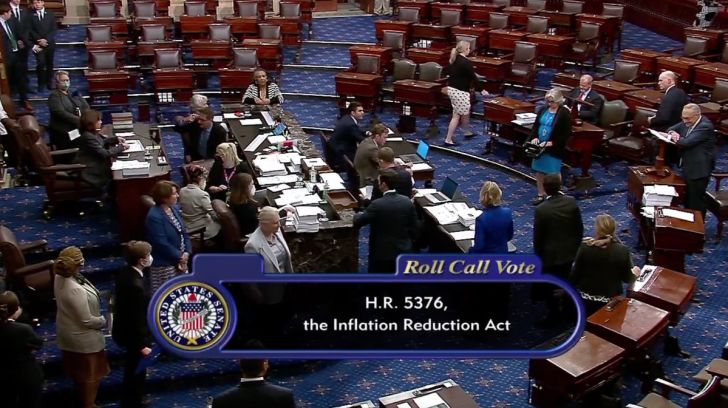

With all that said, US GDP data is out and despite the Ministry of Truth’s attempt to gaslight their own citizens, even going to the extent of redefining what they consider a recession to be, the US has most certainly entered a recession.

Along with confirmation of the US entering recession, we also have updated monthly inflation prints which saw inflation in Australia increase from 5.1 to 6.1 - a 20% increase month-on-month, while the US nears ever closer to double digits printing 9.1%. (Yes, as discussed many times. These numbers are as bogus as Nancy Pelosi’s insider trading - the real numbers are waaaaaay higher!)

The Aussie inflation chart however is a fascinating one to look at; especially when we zoom in a little and consider the trend and the previous structure. As you can see from the lows which i’ve highlighted below; Every low is a higher low structurally which shows the pressure to the downside is decreasing with each low that has been printed and indicates some what of a consolidation is taking place. The other point of interest is that the previous long term resistance which goes back to the 90’s has been breached and we are now seeing the highest levels of inflation for 32 years in Australia. The final data i’ll highlight is the level around 7% where you can see i’ve drawn a horizontal line. If Inflation data increases and confirms with a further increase beyond this level if i was simply following the trend I would put the probabilities in favour of inflation pumping its way up toward the previous local high toward 10%, and very likely higher over time. But the overriding point i’m wanting to make is simply that until we can confirm otherwise, the trend of higher inflation is not going anywhere. That is not to say it cannot change, but until there are clear signs of a reversal in the data, the this looks more like a major breakout than anything else, and much higher levels are more probabilistically likely. Breaking out of a 32year period of consolidation is not an insignificant thing, and the worst thing we could do downplay it’s significance. It should be best thought of as a coiling spring or a building of pressure. The longer and further the spring is held down, the more significant the expansion is likely to be when that pressure is released.

This is what we are currently seeing -a major expansion off the lows.

Meanwhile the broad trend with fiat is well established - it trends toward zero in value while the supply of units continues to expand over time. Bitcoin does the opposite. The supply is fixed and the issuance continues to halve every four years until the supply cap is reached somewhere around 2140.

Political monies trend toward zero, while Bitcoin will trend up and to the right into infinity. Act accordingly.

Wishing you all well. Hope you have a great day. Talk to you tomorrow.

AK

Share this post