Good Morning Everyone,

Fidelity Digital Assets have come out with a new research paper entitled:

“Bitcoin First: Why investors need to consider bitcoin separately from other digital assets”

The paper is well worth a read and i’ve linked it above. Essentially Fidelity very succinctly explain, what many people seem to fail to understand about bitcoin -

What it actually is?

That bitcoin is the most pristine version of ‘money’ ever realised by human civilization, and is at the same time, the most sophisticated monetary network in history.

Hopefully if you’re reading this, then you are already well ahead of the audience this paper seems to be aimed at, but its extremely positive to see this major asset management firm, really get it.

Within the papers executive summary, they highlight the following key points:

“Bitcoin is best understood as a monetary good, and one of the primary investment theses for bitcoin is as the store of value asset in an increasingly digital world.

Bitcoin is fundamentally different from any other digital asset. No other digital asset is likely to improve upon bitcoin as a monetary good because bitcoin is the most (relative to other digital assets) secure, decentralized, sound digital money and any “improvement” will necessarily face tradeoffs.

There is not necessarily mutual exclusivity between the success of the Bitcoin network and all other digital asset networks. Rather, the rest of the digital asset ecosystem can fulfill different needs or solve other problems that bitcoin simply does not.

Other non-bitcoin projects should be evaluated from a different perspective than bitcoin. Bitcoin should be considered an entry point for traditional allocators looking to gain exposure to digital assets.

Investors should hold two distinctly separate frameworks for considering investment in this digital asset ecosystem. The first framework examines the inclusion of bitcoin as an emerging monetary good, and the second considers the addition of other digital assets that exhibit venture capital-like properties.”

Bitcoin is both an asset and a monetary network.

This single distinction is of major significance. Regardless of whether or not you have any interest in the underlying unit of account as part of the 21m capped issuance - the capability of the network is indisputable at this point and enables the most secure method of information transfer, that is value transfer, between peers in an essentially trustless manner that has previously never been possible digitally.

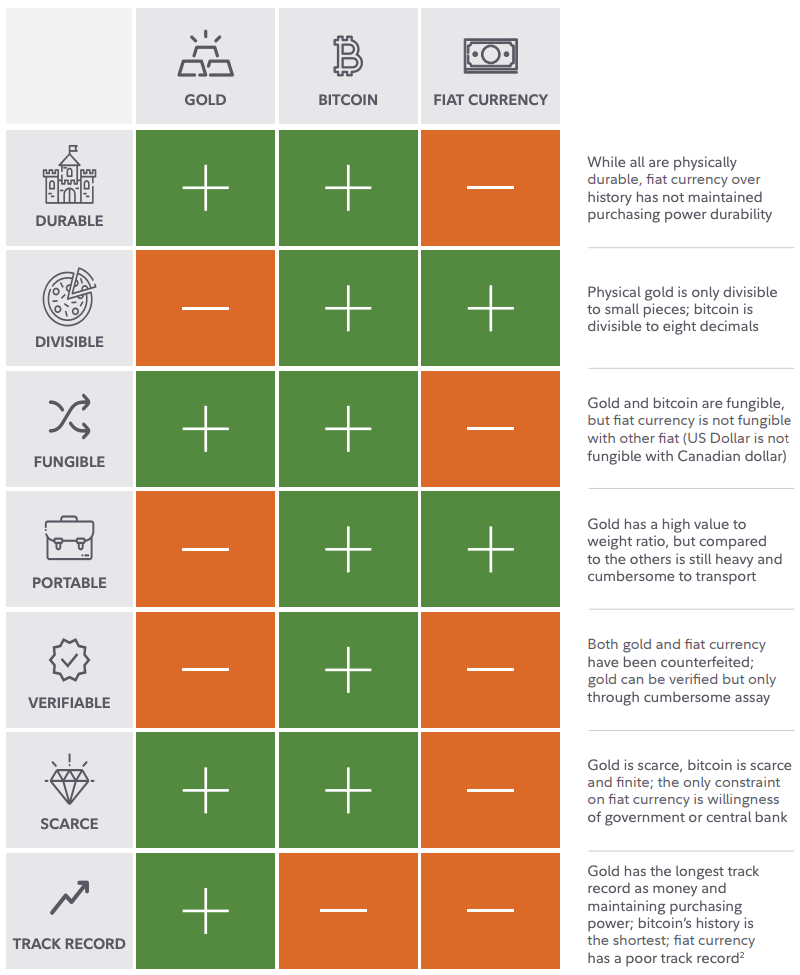

The article goes on to review the properties of money, that scarcity drives value and how the consensus mechanism and design of the protocol essentially ensure the near-zero probability that it could ever change.

It’s fascinating to me, the way they refer to bitcoin writing things like:

“How bitcoin may position itself against the rest of the digital asset ecosystem”

When in actual fact, we’re referring to an inanimate object. Not even a physical object. A code-base, a language, that can be run on a computer anywhere in the world, and by connecting to the internet and joining the network spawning the worlds most sophisticated monetary network of all time. This still blows my mind when you really get to the fundamentals of what we’re actually talking about here.

It’s much less a case of bitcoin positioning itself as anything, but rather people actually beginning to understand what it actually is and treating it accordingly.

This technology has been operating on tens, then hundreds now thousands of computers on earth for 13 years, producing block after block consistently and without interruption, operating flawlessly, never forcing a single person to use the protocol or to join the network. Simply executing transactions and transmitting information, while humans try to make sense of what it is and form their beliefs about it - and it will continue to do so indefinitely while a consensus exists of its monetary superiority. Pretty incredible!

And with each person that does, the network effect grows stronger, and stronger.

The article goes on to state that they believe bitcoin has the potential to be the primary monetary good as a result of the power of monetary network effects.

“We won’t be so bold as to predict there will only ever be one money, but we do believe that one monetary good will come to dominate the digital asset ecosystem due to the very powerful effects of networks.

Many investors are familiar with the power of network effects, where the value of a given network increases exponentially as the number of its users grows.

Monetary networks are no different. However, they are even more powerful than other networks because the incentive to choose the right money is much stronger than any other choice of a network, such as a social network, telephone network, etc.”

They go on to discuss the reflexivity of the bitcoin network:

“There is also a reflexive property to monetary networks. People observe others joining a monetary network, which incentivizes them to join as well as they also want to be on the network where their peers or business partners reside.

This can be observed on a smaller scale with payment networks today as platforms like PayPal and Venmo have grown at an accelerating rate.

In the case of bitcoin, the reflexive property is even more pronounced because it doesn’t just include passive holders of the asset, but it also includes miners that actively increase the security of the network. As more people believe bitcoin has superior monetary properties and opt to store their wealth in it, demand increases.

This in turn leads to higher prices (particularly as supply is inelastic or unresponsive to price). Miners are then incentivized to increase their capital expenditure and computing power as higher prices leads to higher profit margins. More computing power devoted to bitcoin mining leads to higher security of the network, which in turn makes the asset more attractive, leading once again to more users and investors.”

I don’t think this can be overstated.

Fidelity manages more than 3 trillion dollars in assets, and if they believe Bitcoin is likely to be the single best monetary good on the planet, what do you think they will tell their clients to do? The demand for this asset is going to get absolutely wild.

[correction: Fidelity total Assets under management is in excess of $10,000,000,000,000 (trillion)]

It blows me away to read this kind of stuff from massive institutional asset allocators. It’s the first piece I’ve read that really gets to the core of Bitcoin and does a good job of accurately outlining bitcoin and appropriately differentiating it from VC like bets in respect to other “digital assets” (read: shitcoins).

I have absolutely no interest in gambling on shitcoins, when we’re living through the real-time monetization of the worlds most pristine monetary good and network.

It’s never been more obvious than it is today.

There has never been an open, global monetary standard like it.

Sooner or later, everyone is going to realise it.

Seize the asymmetry before they do, and opt-in to the peaceful revolution that is the bitcoin network.

Hope you have a great day, and i will chat to everyone tomorrow.

AK

Share this post