Good Morning Everyone,

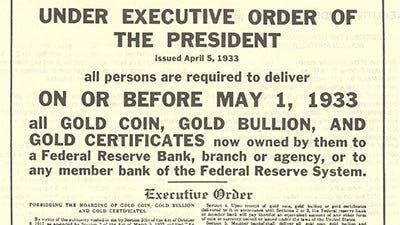

This morning the Lebanese Government has announced the state and the central bank are officially bankrupt. This announcement comes on the anniversary of the US government confiscating gold from their citizens 89 years ago.

The Lebanese deputy prime minister had this to say:

“The losses will be distributed to the state, the Banque du Liban, banks and depositors, and there is no specific percentage. Unfortunately, the state is bankrupt, as is the Bank of Lebanon, and we want to come out with a result, and the loss occurred due to policies for decades, and if we did nothing, the loss would be much greater.”

What an absolutely stunning statement to read.

Only a few months ago I’d discussed the hyperinflation within the country and the breakdown within food and energy markets. Now the truth finally comes out. They’re broke.

This is a microcosm of the broader world on a fiat standard.

If citizens of Lebanon listened to these lunatics and trusted their government, and they continued to hold their money with a bank, it would now be clear that they were lied to and they’re now broke. If they used bitcoin to store their wealth, they will have successfully insulated themselves from some of the madness and at least have some options moving forward.

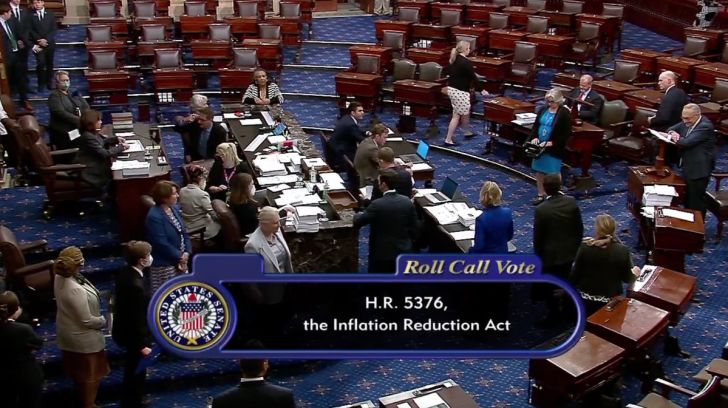

A separate but relevant video has been circulating which includes Stephen Poloz, Former Governor of the Canadian Central Bank being asked about “opting-out” of inflation using bitcoin. The video is extremely enlightening and worth a listen. It’s attached below.

He was asked:

“Central banks are a key feature of Pierre Pollievre’s campaign and he had a big rally - 1000 people in Ottawa recently - and he said Canada should become the crypto capital of the world because Canadians need to be in charge of their own money supply and he used the phrase ‘through bitcoin you can opt-out of inflation’. How do you interpret what he means by opt-out of inflation by using bitcoin and controlling our own money. What’s your response to that?”

The former Governor of the central bank responded as follows:

“Well firstly i think Canadians do control their own money through their own central bank in a very transparent process by which it’s administered. But setting that aside, being on a bitcoin standard would be very similar to being on a gold standard except more volatile. A gold standard does limit inflation, so if the price of oil doubled or something like that all the other prices in the economy would need to go down in order to off-set it. That’s the sort of deflation you get during a depression. It’s why we had the big depressions, [and] were during the gold standards years. The Victorian depression and the depression during the 1930’s. Those would not have happened if we’d had a more conscious monetary policy and expanded the money supply to meet the increased supply that came from the industrial revolutions. So i think there is a way around all this which is to say we have an inflation control agreement - That’s how Canadians control their money supply.”

He was then asked:

“So for the people fascinated with Bitcoin - Can you through anything “opt-out” of inflation?” and responded as follows:

“Well, no. Because bitcoin is not a legitimate transactor vehicle. It’s highly variable. So the price of things you would buy would be varying all the time. Digital currencies in a broader concept they’re definitely coming but they’ll probably be official ones, you know the same kind of money we use every day thats in our pocket. But opting out of inflation I just don’t understand that concept. Like when the price of oil doubles, how do you opt out of that?”

There is so much to unpack from this short clip, it’s scary. The fact that he thinks sound money is the reason for depressions is completely insane. I do think they are speaking in respect to one kind of inflation, which is price inflation and not in respect to inflation of the money supply. This is muddying the conversation.

What seems abundantly clear is that it is the belief of this former central banker, than sound money is bad, and having an elastic monetary system where they can more “consciously” massage the supply of monetary units, and thus confiscating value from you, is good. Not to mention the ability to be able to simply exclude you from the system as we saw with the freezing of citizens bank accounts with the Canadian truckers.

These people are not going to save us. Ask anyone in Lebanon now how much they trust the word of the government or central bank, and i’m sure it is decisively less than 12 months ago.

They have no interest in learning about or understanding bitcoin, but will force you to adopt their “official” version, that enables all kinds of parasitic capabilities over your money and spending, and essentially gives them an on/off switch whereby they can exclude anyone from the system with the press of a button.

These over controlling central planners have not learnt anything from the last 50 years and seem insistent on keeping the charade going. I don’t think they honestly believe they can control everything, but rather than can trick enough people into believing whatever they tell them.

I believe that they’re underestimating the mind virus of bitcoin and are in for a surprise. History will be written by the victors, and i’m betting on the smartest minds on the planet and the simple fact that open networks win.

It’s unimaginable to me that anyone would choose to continue to trust these people after what we have seen. Maybe i’ve been living in my own echo chamber for too long? Possible. But a world dictated by a closed, censorable and permissioned monetary network like what central banks want, is a world I want no part of.

The future of money already exists. It’s free to join, and anyone is welcome.

Wishing you all well. I’ll talk to everyone tomorrow.

AK

Share this post