Good Afternoon Everyone,

Following on from yesterday’s letter..

Let’s address how much energy the Bitcoin network actually uses.

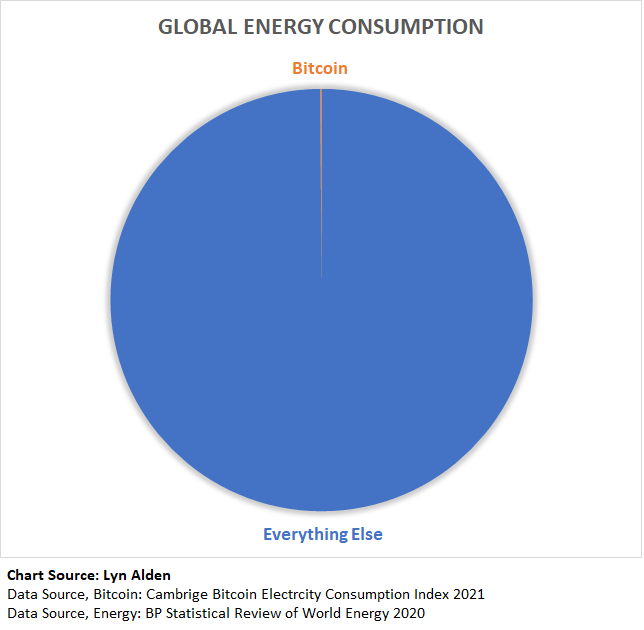

Cambridge Bitcoin Electricity Consumption Index is the most-cited source estimating current annualised electricity usage at 126.25 TWh.

To get a perspective of what this means - The entire world uses in excess of 170,000 TWh per year of electricity.

This means that the Bitcoin network at peak estimated consumption uses <0.1% of the worlds energy.

To quote Lyn Alden from an exceptional piece she wrote on the topic:

Bitcoin’s energy usage is a rounding error as far as global energy usage is concerned. And I mean that literally; when scientists estimate that the world uses a certain amount of energy in a given year, they can easily be off by a couple percentage points in either direction, let alone a couple tenths of a percent. Bitcoin is estimated to use less than one tenth of one percent.

Plus, a large percentage of the energy that Bitcoin uses is from otherwise-wasted energy sources.

I recommend you read Lyn’s article linked above for a deeper dive.

I think it is also extremely helpful to understand why the bitcoin network uses this energy, and the fact that this is actually a design feature of the system, and not a bug.

The act of ‘mining’ using the proof-of-work consensus mechanism is what secures the network. It is counter-intuitive but you actually want it to be expensive and thus difficult for any individual to amend the blockchain by adding a block. The immutability of the global ledger is critical. If anyone could easily do so, the network would be vulnerable to easy and frequent attacks and render the system useless. The expense to do so, which is the projection of power, deters would be attackers and thus secures the network.

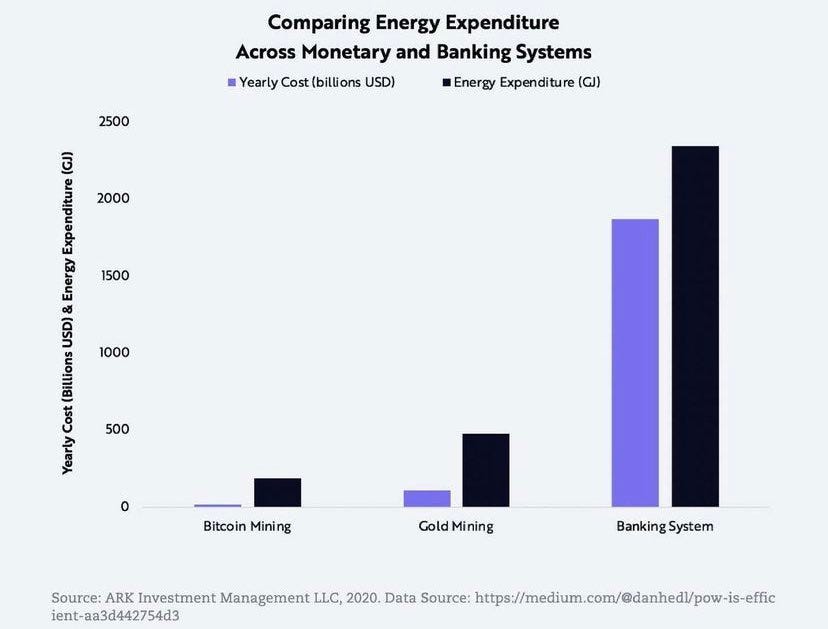

This is necessary for a global monetary system and in actual fact, as you can see below, in comparison to the current system it is wildly efficient, contrary to what you may have heard.

According to ARK Invest analyst Yassine Elmandjra:

Traditional banking emits 1,368 Megatonnes (Mtoe) of carbon per year and gold mining emits 144 Mtoe. Bitcoin emits 61 million Mtoe, less than 5% and 45% of traditional banking and gold mining, respectively.

As Nick Szabo said in his article ‘Unenumerated’ in 2017

“Prolific resource consumption and poor computational scalability unlock the security necessary for independent, seamlessly global, and automated integrity.”

The other thing to mention in respect to total electricity utilisation that is very much relevant, is the total number of network users. The current number of network users is relatively small compared to a pre-existing technology like the internet, and a common concern is that as this number grows, then so will the total electrical consumption, and the network clearly has plenty of growth likely ahead of it.

Estimates of this number vary, and the truth is that it’s impossible to ever truly know the total number of network users - we can only ever estimate.

In 2021, estimates show approximately 106m users. An obvious concern would be if the electricity usage increases linearly with network user growth then the resources required to run the network could become more significant - but this is not how the system works. There is limited space per block, and limited blocks mined p/day, and its unlikely for this to change. The scaling will happen on a L2 solution like the Lightning Network, and the base layer is preserved in order to optimize for security.

To quote Lyn again:

In the very long run, if Bitcoin is wildly successful and becomes a systemically important asset and payment system used by over a billion people at 10-20x its current market capitalization, it should reach several tenths of one percent of global energy usage.

The point is that the Bitcoin network is and forever will be a rounding error as far as global energy consumption is concerned, whether it’s successful or not, and its energy usage won’t exceed its long run utility (however high or low that utility ends up being).

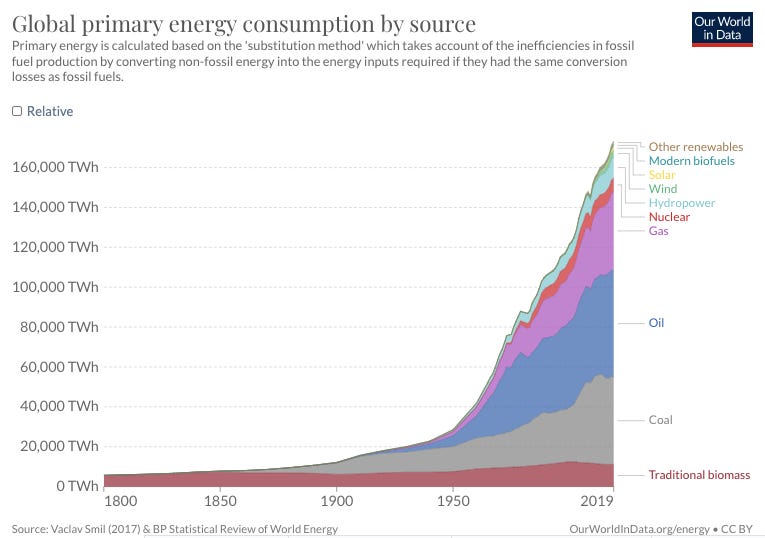

The next fragment in this conversation is the sources of energy used. Below is a chart showing the global energy consumption by source.

As you can see, a very small fraction of total energy consumption is derived from renewables, and anyone that knows anything about the complexities of supplying base load electricity to a grid will tell you that it’s highly unlikely that renewables are going to be able to provide for this any time soon. To rely on renewables for anything more than a minor bump to overall capabilities would commit us to descending back into the dark ages, and i mean that literally.

Estimates of Bitcoins energy sources vary significantly from a 2019 report suggesting 73% of mining is carbon neutral while the CCAF indicated in a 2020 report that the figure is closer to 39%.

Given that it’s been established that total energy usage is essentially a rounding error globally, the complaint that the energy is primarily derived from fossil fuel sources is trivial, and to get distracted by this narrative would be a mistake as the percentage mix even at the lower end is still close to half and it is only likely to increase over time.

What is much more relevant to highlight is how bitcoin actually incentivises the sourcing of renewable energy. Infact, bitcoin mining is a major innovation in this respect.

Bitcoin mining as a technology can be moved basically anywhere and can monetize resources that would otherwise not be economical to do so for various reasons whether it be transport or cost. So if the energy is cheap or near free, miners are incentivised to find it, and use it. This is such a big deal, and it is still not well understood. Take El Salvador for example:

They are now building a mining facility to convert the previously untapped geo-thermal energy into electricity from a nearby volcano. This energy has always been available - but never utilised. This could be used to support the grid if needed, and if not they can monetize it and be mining bitcoin from a free energy source.

There is a huge amount of complexity and nuance to this topic, but i believe it will prove to be one of the most significant energy developments in decades, and will lead to a reduction in consumer energy costs over time helping us to utilise previously inaccessible energy sources and create powerful incentives that will drive competition in the market place.

Jack Dorsey’s company Square published a whitepaper on the topic, and provided the following in summary:

Bitcoin miners are unique energy buyers in that they offer highly flexible and easily interruptible load, provide payout in a globally liquid cryptocurrency, and are completely location agnostic, requiring only an internet connection. These combined qualities constitute an extraordinary asset, an energy buyer of last resort that can be turned on or off at a moment’s notice anywhere in the world.

As i said yesterday - it really boils down to the following:

Do we value having an immutable monetary network completely separated from ‘the state’ and political actors? A single global monetary network with the properties that the Bitcoin network provides.. A network that is available to anyone, but is owned by no-one. And if so, how much energy as a percentage of societies resources is an acceptable allocation for the benefit this technology affords us as a global people?

In my opinion to argue against the value of the network and the bottom-up innovation it incentivises is equivalent to simply not understanding it. It can only be done from a position of ignorance. I have not heard a single argument against it, from someone that has actually done the work to understand it.

We have a global settlements layer, a single global monetary standard, that from an energy usage perspective, will always be a rounding error, and incentivises the use of cheap and previously unused renewable sources that can drive down the cost of electricity production worldwide for consumers and lead to greater availability and reduced cost to supply. And this innovation is still largely not well understood. Imagine the impact after another 10-20 years!

Hope that’s helped to clear up some questions.

Hope you have a great day, and i’ll speak to you tomorrow.

AK

Share this post