Good Morning Everyone,

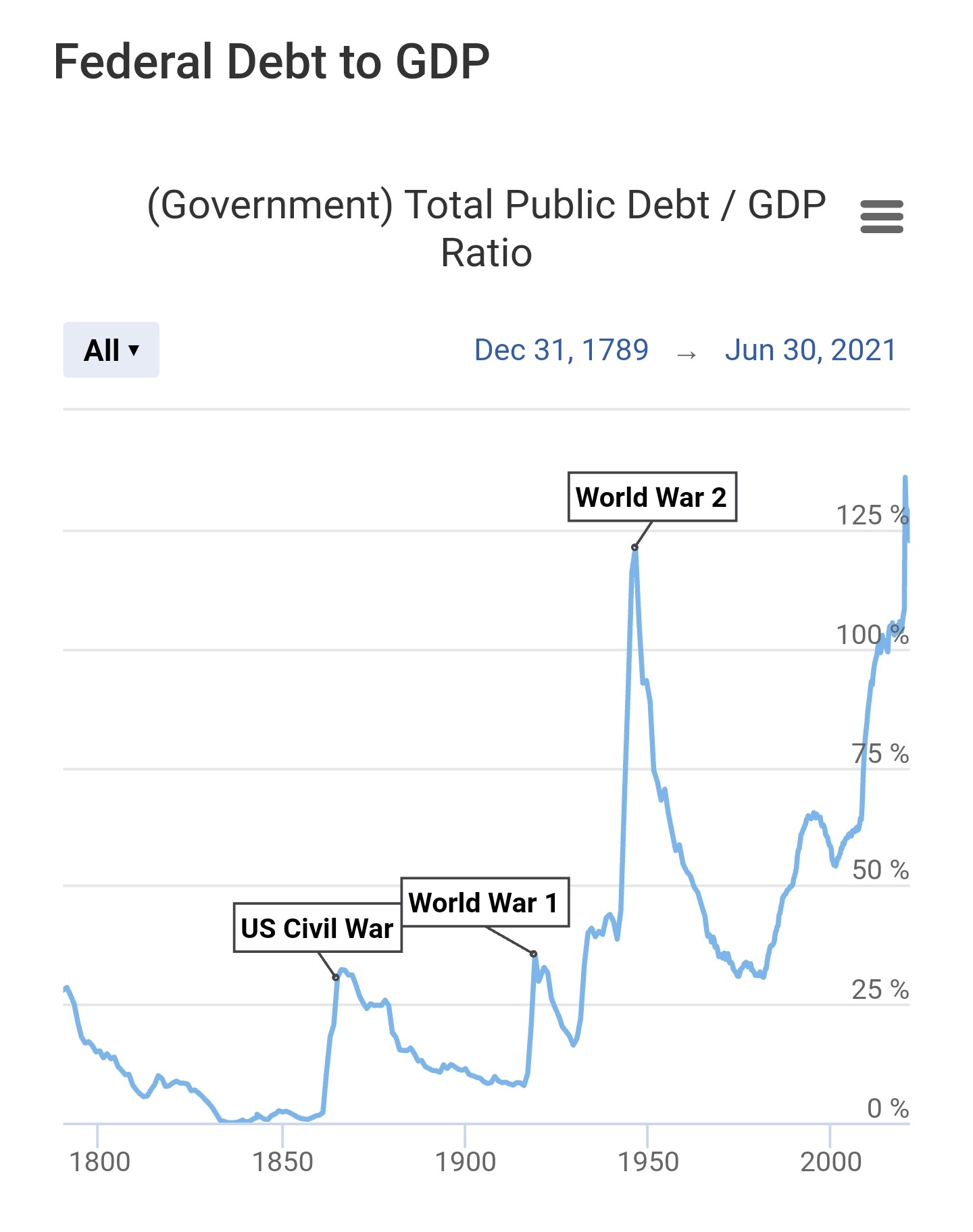

I’ve been looking at the following chart for weeks, and it continues to provoke deep thought and enquiry.

The chart shows US federal debt as a percentage of GDP (Gross domestic product), and highlights a fairly obvious trend. That is, that times of relatively high debt to GDP have historically been a catalyst for some kind of war.

This trend begins with the American Civil War which began in April 1961, with debt/GDP in the early 1850s bottoming in the low single digits and rising to around 30% at the peak. This was followed by WWI which began in 1914 (one year after the US fed was established) and saw peak debt/GDP only slightly higher than the prior.

It only took 25years between WWI and WWII in 1939 with debt/GDP absolutely skyrocketing to almost 125% - orders of magnitude higher than the previous. The Bretton Woods Conference and subsequent monetary reset signaled an end to the second world war in 1944.

Since WWII we have had perhaps one of the most peaceful periods in history. However the writing is currently on the wall with debt/GDP printing all-time highs, at the same time while we experience levels of civil unrest in countries all around the world in reaction to government responses to COVID-19.

So are we heading for a World War? I have no idea, but the trend here is compelling.

It sparks me to wonder:

Is war a catalyst for monetary reset? or is it the other way around..

Is monetary reset a catalyst for war?

I do not know the answer for sure. But it seems clear to me that of the American Civil War, WWI and WWII, the two have gone hand in hand.

We now live in a much more global, interconnected and inter-reliant world than ever before, and this world and the geo-political dynamics are punctuated by nuclear capabilities which somewhat stalemates the nature of power projection, as the result of a nuclear conflict would be catastrophic.

Clearly high levels of debt, just like household debt, have higher order effects, and cannot be sustained over time. It’s interesting to think about our current debt based system, and be curious about the relationship between high levels of debt, which create stress and inequality (among other things), and how this trend has compounded over time, and to wonder how things would be different if we adopted a system that prevented these kinds of dislocations and excessive debt bubbles were not possible to inflate.

The elasticity of the fiat standard appears to have enabled a lot of progress, and one could make arguments for the efficacy of this. It’s also possible that it’s simply prolonging the inevitable, and by doing so, the eventual outcome be significantly more extreme.

All i know, is that we’re living in an upside down world, where debt (liabilities) is treated like assets, and assets like liabilities, and that at some point the trend will revert to the mean.

Whenever this happens - Would i prefer to hold a debt based asset or the most pristine collateral that’s ever existed?

You already know my answer.

This is something that everyone needs to figure out for themselves, but one thing is for sure.. You would rather be a year early than a single day late.

Something to think about…

Wishing you all well, and I will talk to you on Thursday (Aussie Day tomorrow).

AK

Share this post