Good Morning Everyone,

As most of you know i tend not to talk too much about bitcoin price action in these letters, as i view the price relative to USD shitcoins as more of a distraction than anything else, as the true unit of account in my opinion is bitcoin or sats. Measuring this truly inelastic asset against something that has and will continue to be created into infinity makes little sense in my mind, and it’s not until you replace your UOA for sats that the true state of play begins to become clear. However I realise the USD price can be a vacuum for the attention of many, and particularly those early on their journey down the bitcoin rabbit hole so i wanted to make a couple of comments as the price breaks down below $31,000USD.

The first thing I wanted to note is that for the class of 2021 that purchased in or around the 60k level, being at a 50% drawdown can be psychologically challenging. There is no way to make this process easier, and infact, there is much to learn about ourselves in these moments if we are willing to pay attention. One thing that must be said however, is that the situation can definitely be made worse by capitulating and selling your bitcoin due to the perceived psychological discomfort you may experience as a result of price fluctuations.

It’s important to recognise the mind game of markets. The market as you perceive it, measured by prices on a screen, is designed to trigger you psychologically to press a buy or sell button. But the market cannot touch you, or move you arms or legs, or physically force you to do so. It does so by triggering you emotionally. Which is to say you do it to yourself.

However if you train your attention, you can choose to channel your focus elsewhere and become agnostic to the whims of the market. This ability is a super power, and a necessary one to be successful over time.

This quote from Charlie Munger hits the nail on the head:

“If you’re going to be in this game for the long pull, which is the way to do it, you better be able to handle a 50% decline without fussing too much about it.”

My advice for anyone in this phase is the following:

Zoom out. Get clarity on your thesis, and write it down on paper.

If you are worried it’s often because you’re suffering from the fiat disease of a high time preference. Zooming out and gaining clarity over your thoughts and expectations will help you in deploying patience. Your inability to do this also offers a hint for what you need to do next. It highlights your lack of conviction;

Build Conviction by learning.

If you are worried, you lack conviction. This typically indicates you only really entered at the prospect of price increasing and being able to sell to someone else at higher prices. Pure speculation in other words. This is not on it’s own a bad thing, it’s only an issue if you are suffering from a level of self deception and don’t realise it. If price is all you are thinking about, you do not yet understand what bitcoin is. Focus on learning. Stop looking at price and do the work. Read the books instead of fixating on price. Conviction = a low time preference.

Focus On The Lows, Not the Highs.

This flipping of perspective can be a powerful reframe to help you have a more realistic and productive frame of reference over the variability of price, and to provide a vantage point that is more conservative and less euphoric.

Perspective Is Everything

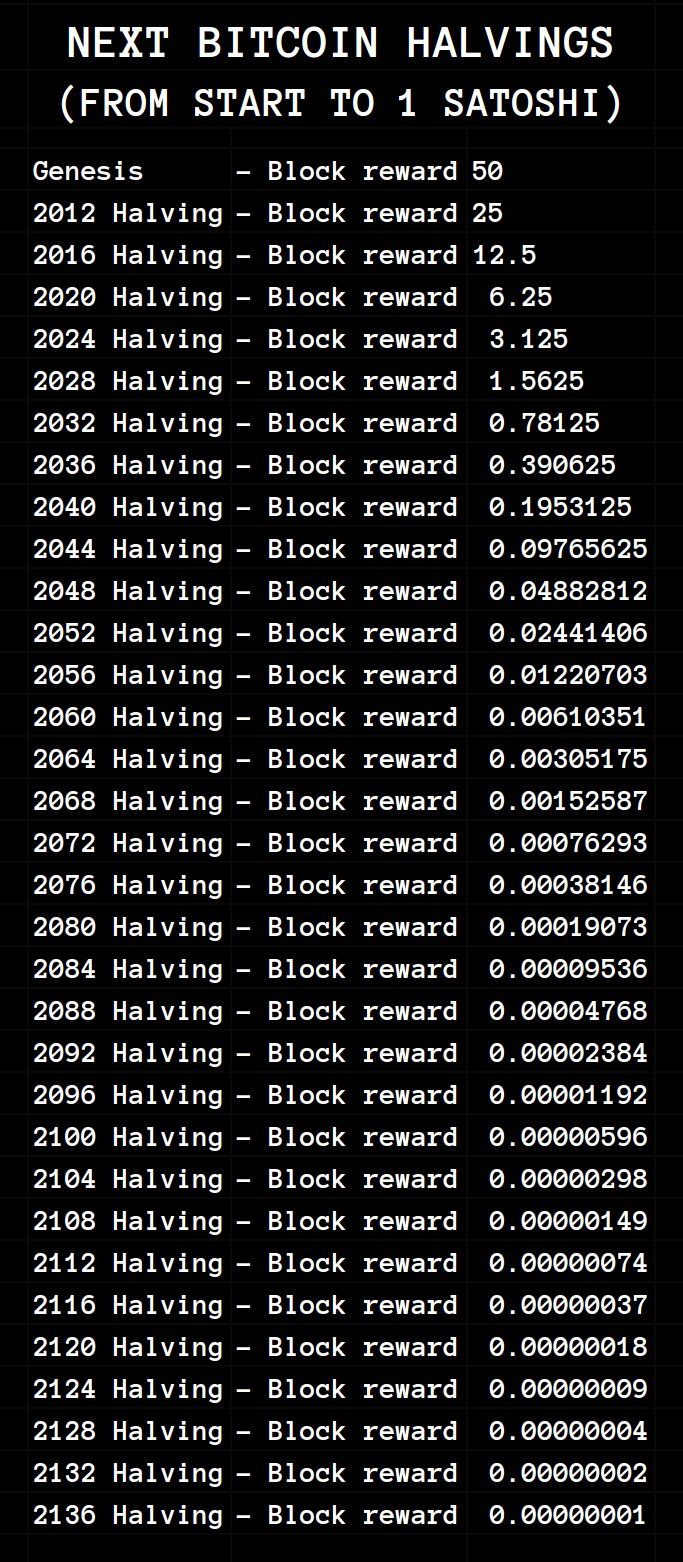

This tweet perfectly articulates the typical failures of the human mind in truly grasping time and the changes that occur over it. In 6 short years, as the next halvings are in 2024 and 2028, the block subsidy or issuance of bitcoin will be reduced to 1.56 bitcoin. Meaning the reward that miners earn for securing the network in 2028 could be purchased today for $53,000.

Zooming right out and looking at how the deflationary model of bitcoins issuance changes over time, is a powerful tool to visually capture the alien concept of true digital scarcity.

Get Your Bitcoin Off Exchange & Custody Your Keys

This one is pretty self explanatory, but it’s of the upmost importance. It’s extremely likely that there are many more IOUs that exist for bitcoin, than actual bitcoin. If you hold your bitcoin on an exchange all you own is an IOU. In the event that everyone wants to redeem their IOU at the same time, ie a run on the bank or exchange, anyone that has given the privilege of custody of their keys to said exchange is exposed to counter-party risk, and risks loosing their bitcoin in the event the exchange fails under this stress test. It is only those that custody their own keys who are truly immune.

Personally, I choose to view this phase of the market cycle as necessary, healthy and unavoidable. When we have capital being allocated to jpegs of rocks and apes, and the average “investor” thinks shitcoins are anything other than a scam, these phases of the market in my opinion are the naturally occurring mechanism to help educate us and expose our delusions and recalibrate the market - us - on what is likely to be true.

Often this comes with some pain, but this is part of the game. This pain is an important and necessary process, and for those that are paying attention you soon learn - that you either win or you learn. If the market provides you with some tuition, which is typically expensive, you best listen and pay attention. Otherwise the market has a funny way of running the same clinics for you, until you do.

Hope you have a great day. I’ll talk to you tomorrow.

AK